If you own any stock, even a few shares, this is the time of year you can make your voice heard in the corner offices of the world’s largest public corporations.

Most companies hold their annual shareholder meetings between March and June. And now, thanks to a U.S. Securities and Exchange Commission rule that emerged from the 2010 Dodd-Frank financial reform act, publicly-held companies are required to put their executive pay packages before shareholders for a non-binding vote.

And that’s the inequality focus for our program today: inequality in what people get paid…within the same company.

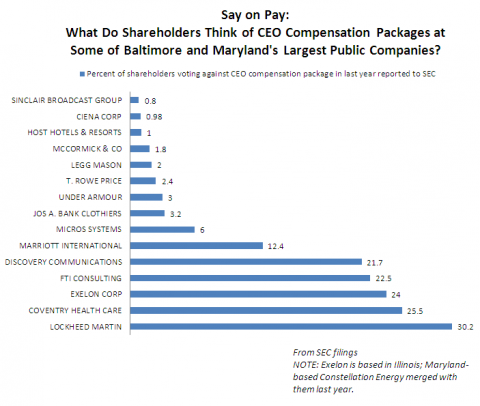

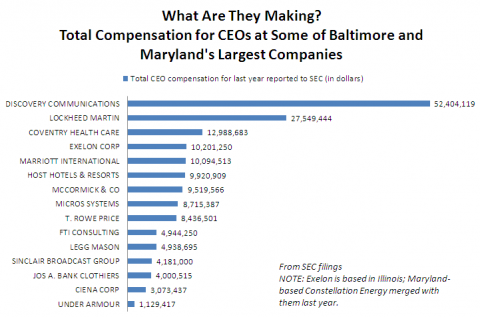

Above, you can see what CEOs make at some of Baltimore and Maryland's largest publicly-held companies, Below: how their shareholders voted on some of those compensation packages.

In the podcast, senior producer Lawrence Lanahan looks at what shareholders, government agencies, and legislators across the nation—and here in Maryland—are doing to try to reverse the trend.

Then--why has CEO pay risen so sharply compared to regular wages? The ratio of what a CEO gets paid to what that company’s average worker gets paid. That ratio was about 40 three to four decades ago. Measurements over the last few years capture it well over 300. Sheilah explores this with Michael Faulkender, associate professor at the University of Maryland’s Robert H. Smith School of Business.

The webinar from Equilar that Lawrence mentioned is helpful for understanding all these issues; you can register to view "Executive Pay in the Say on Pay Era" here.

We reached out to CEOs at 15 of Baltimore and Maryland’s biggest public companies. Under Armour’s Kevin Plank was traveling and couldn’t join us. A Lockheed Martin spokesperson said CEO Marillyn Hewson might be able to answer questions by e-mail, but she had not responded by yesterday afternoon when we produced this piece. The other 13 companies either declined to participate or didn’t respond.

We also asked all 15 companies to provide ratio between the CEO’s compensation and the median compensation for the rest of the workers--a ratio that Dodd-Frank says the SEC will eventually have to demand. None provided it, but we’re still leaving a blank in case they eventually do; see below.

In that list of 15 is one company not based in Maryland: energy giant Exelon, based in Illinois. We included them because they recently merged with Constellation, which had been one of Baltimore’s biggest public companies. Former Constellation CEO Mayo Shattuck III, who is still based in Maryland, retired from Exelon on February 28. His pension plan is valued at over $49 million.