As part of our fourth episode, "Foreclosed," the nonprofit investigative news outlet ProPublica was kind enough to share some data they collected while reporting on foreclosures in Baltimore.

As ProPublica's Jennifer LaFleur told us, Baltimore deviated from the "lending gone wild" narrative: 69 percent of the loans ProPublica examined in Baltimore were for purchase, not refinancing, and a majority of the loans were fixed, not adjustable. What didn't help was that the initial interest rates on Baltimore loans were overwhelmingly high--more than half were over 8 percent.

You can see lots of that data at the ProPublica/Seattle Times interactive feature here. (And here's their methodology.)

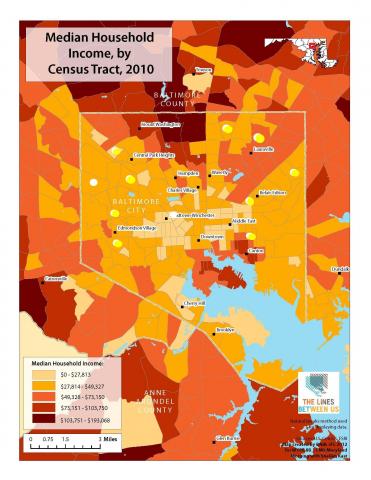

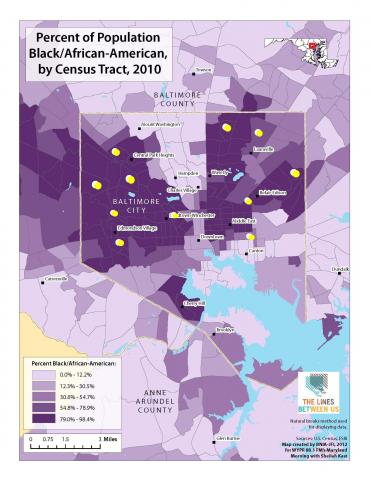

We took some of ProPublica's data and merged it with some of the maps created for us by the Baltimore Neighborhood Indicators Alliance (BNIA). ProPublica isolated the 10 Census tracts in Baltimore that had the most foreclosure filings out of their random sample. We've plotted those foreclosure hotspots below as yellow dots on our BNIA maps of Baltimore's African-American population and median household income.